Personal debt is one significant obstacle to financial independence. According to the American Consumer and Financial Services Bureau, almost 40% of Americans have more than $336,000 in personal debt.

Almost ten years earlier, I was in debt. I owed over $30,000 in credit card balances, personal loans, and unpaid taxes.

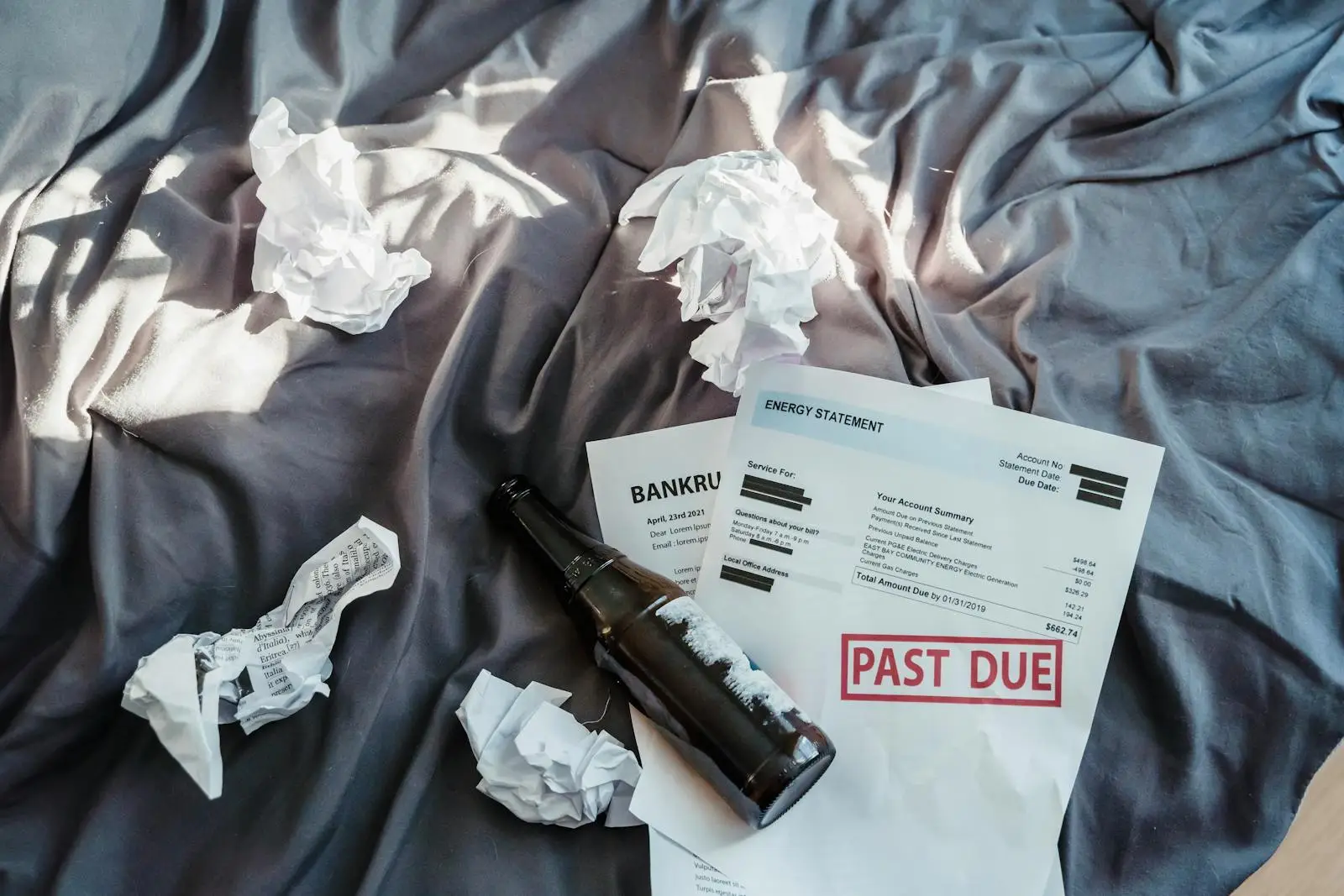

Personal Debt Affects Your Mental Health

I must admit it was not a great time in my life. I hardly slept, and I lived in denial of the fact that being indebted was the cause of my emotional disturbance.

Looking back at those years of being indebted, I realized I was suffering from the impact of personal debt on my mental health.

Individuals who have high levels of debt are more likely to develop anxiety and depression, according to findings from the British Home Panel Study (BHPS )in the UK.

The family and relationship of an individual with personal debt also suffer from the impact of their behavior.

I remember how my wife broke down in tears and wished we were out of debt during our New Year’s Eve reflection meetings. It was heartbreaking to watch my wife suffer because of my poor financial decision that was pulling our household towards bankruptcy.

I decided to do something different.

Choose Financial Freedom and Take Action

I decided to change my ways and pursue financial freedom instead of slavery to my creditors.

My financial situation appeared hopeless; however, with determination and hard work, I pulled myself from the abyss of personal finances to become financially free.

What did I do differently to move from debt to financial freedom?

Stop Accumulating Personal Debt

My first step was to stop ignoring my debt and face the reality of my financial situation.

I gathered all the statements for my credit card balances, overdrafts, personal lines of credit, and mortgages and recorded my liabilities.

Next, I created a balance sheet of my financial scorecard that reflected my mindset and net worth.

I used the tools I found in reading Robert Kiyosaki’s Rich Dad, Poor Dad book on financial education.

Get Understanding About True Wealth

I used my understanding of my cash flow quadrant to identify my beliefs and attitudes toward managing money. Using the lessons from Kiyosaki’s book, I realized that true wealth comes from having more assets than liabilities.

Using Robert Kiyosaki’s principles, I created a personal balance sheet to determine my income, expenses, assets, and liabilities.

Why? Because my balance sheet gave me an idea of my net worth. By Knowing my net worth, I was able to have more clarity about my financial situation.

After determining my indebtedness, I decided to stop accumulating more debt. I committed to paying off my outstanding debts.

Use The Debt Acceleration Method to Pay off Debt

I was interested in paying off my debt quickly and managing my money correctly towards accumulating wealth.

I used the debt acceleration method to repay my debt in 5 years. I was amazed at how easily I could become debt-free with a simple process like the debt acceleration method.

I want to discuss debt acceleration more because it is possible without declaring bankruptcy or debt consolidation.

The debt acceleration method involves reallocating money toward paying off debt. It is a form of delaying gratification.

Debt acceleration works by allocating a portion of your current income to pay off your debts and the regular monthly payments you already make toward your outstanding loans.

In my case, I could allocate $150.00 for debt acceleration. I applied the $150 plus the minimum payment required toward my credit card debt with the highest interest rate. I continued to pay the minimum balances on my other debts.

As a result, I was able to pay off my high-interest credit card debts in just six months. As soon as I paid off the high-interest credit card debt, I now had $370 ($200 my minimum balance plus $150 my debt accelerator) to add to allocate to paying off the plus the minimum payment required for the following credit card balance on my list. I then repeated this method until I could pay off all my debts except for my mortgage, which had a low interest rate. Paying off my personal loans and credit card debts allowed me more money to save and gave me better financial security.

Keep Track of Your Progress with a Spending Plan

I began tracking my money each month to improve my financial situation. I used a spreadsheet to record my income, expenses, assets, and liabilities. Every month, I entered my income and expenses into separate columns, listing my liabilities at the bottom. I listed my assets in another column to better understand my financial situation.

I aimed to pay off my debt, save more, and increase my assets to generate more income. To achieve this, I stopped using credit cards for impulse buying and began using my debit card. Using my debit card instead of a credit card for daily expenses helped me become more disciplined with my payments. I also downloaded a banking app to track and create a spending plan.

Unlike a budget, a spending plan was a more intentional way to allocate my resources according to my earnings. It helped me avoid the depressing feeling of quickly running out of money and being unable to afford things.

Use A Spending Plan To Build Wealth

Let’s explore the concept of a spending plan more deeply. Developing a spending plan empowered me to focus on building my finances without falling into debt again.

A spending plan is a modified budgeting technique. Firstly, you need to determine the purpose of your expenses and allocate your resources accordingly. Secondly, you need to ask yourself whether spending that money or engaging in that activity is necessary.

The beauty of a spending plan is that it prevents frivolous spending while allowing you to achieve your objectives. For instance, I created a spending plan for entertainment while saving for my children’s college education. By analyzing our monthly expenses on food and education, I developed a plan to pay for them and identified strategies to increase my income to bridge any gaps.

A spending plan helps you achieve your goals while providing opportunities to improve your finances. Utilizing a spending plan, I could reassess my financial situation monthly and identify areas I needed to improve.

A spending plan is superior to a budgeting plan because it allows you to maintain discipline and control over your money. Still, a spending plan provides better control over spending habits.

Save and Invest Regularly to Build Wealth

After paying off my debts, I shifted my focus to paying more towards my mortgage. Paying down my mortgage allowed me to increase the equity in my first house and the money in my savings account. Having more in my savings allowed me to handle any unforeseen situations that may have arisen.

As a self-employed person, I was always very cautious with my finances. I started investing in different real estate avenues as I saved more money. It’s important to note that various real estate investments exist, such as rental and commercial. However, investing is the key to building wealth.

One of my mentors emphasized the importance of saving and taught me that the more I saved, the better my chances of becoming wealthy. It’s worth noting that savings can be short-term, medium-term, or long-term. Thanks for listening

Download a copy of my free financial calculator and reflective workbook to help you get started