Prices are rising, and tariffs are partly to blame. Understanding how tariffs affect your savings is crucial today, as even the most careful savers are feeling the squeeze.

When groceries, gas, and essentials cost more, dreams like vacations, new homes, or a bigger savings account can quickly slip away.

But it doesn’t have to end there. By learning a few smart habits, you can protect your savings — and even grow them — no matter how high costs climb.

Let’s dive into what’s happening and what you can do about it. We’ll also follow the real-world example of Mr. Dee, a police officer who refused to let rising costs steal his financial goals.

How Tariffs Affect Your Savings and Inflation Hits Your Wallet

Tariffs raise the cost of imported goods. Inflation increases the price of almost everything. Combined, they make everyday living more expensive.

Families like Mike and Rina in Vermont are already feeling it. They now spend $300 more each month on basic needs — money that once went straight into their daughter’s college fund.

I faced it too. My family planned a trip to Africa to visit my dad. We budgeted carefully, but inflation shattered our plans. Airfare jumped from $8,000 to $15,000. With hotels and transport, the trip would cost $22,000. We pressed pause. Our priorities — kids’ tuition, mortgage, and everyday essentials — had to come first.

Build a Rock-Solid Savings Plan

- Emergency Savings: Cover 3–6 months of essentials (mortgage, taxes, insurance, utilities, groceries).

- Medium-Term Savings: Prepare for big costs like cars, home down payments, and college fees.

- Long-Term Savings: Build your retirement fund and other future dreams.

Jim Rohn, legendary speaker, put it perfectly: “Learn to save 30% of your income and live off the remaining 70%.”

Tools to Stay Ahead

1. Count Your Money

Track every dollar you earn and spend. Use a simple tool like Excel, a notebook, or an app like EveryDollar. Create a basic Personal Financial Statement:

- List your income

- Track your expenses

- Record your assets and liabilities

2. Use Zero-Based Budgeting (ZBB)

Start fresh each month. Don’t assume any expense is permanent.

- Ask: Does this spending help me reach my financial goals?

- Would I still pay for this knowing what I know now?

Cut anything that doesn’t add value.

3. Pause and Prioritize

Each month, pick 3 expenses to pause or cancel. Redirect that money to savings or debt payments.

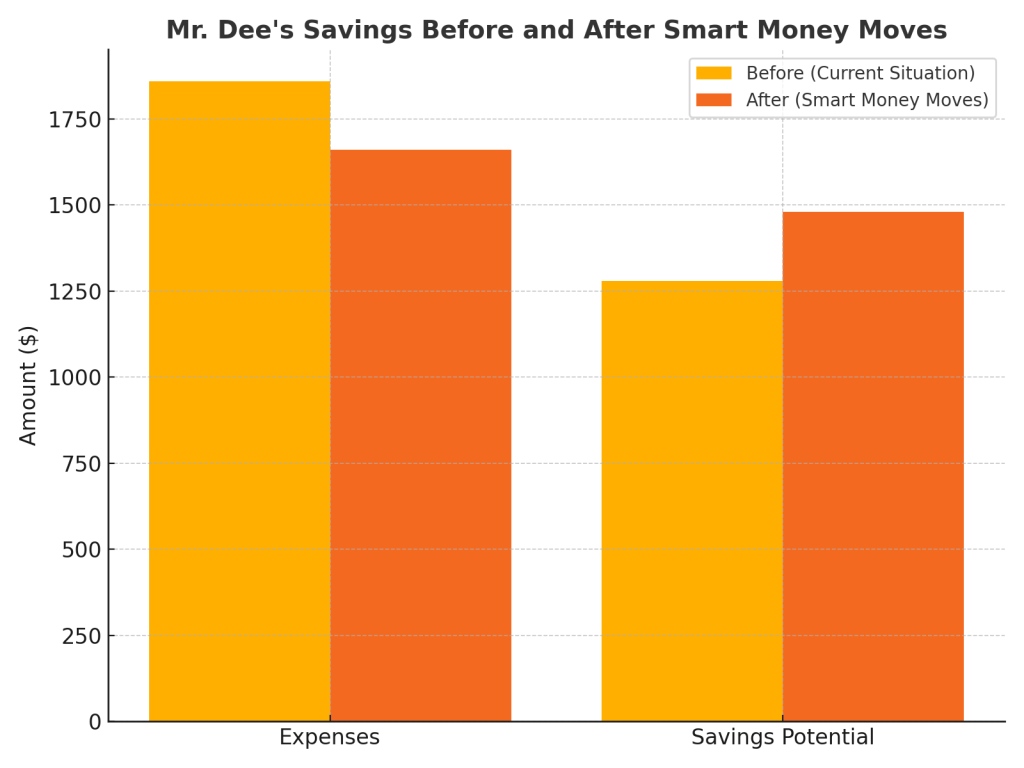

Real Example: Mr. Dee’s Winning Money Moves

Meet Mr. Dee. He’s a police officer earning $2,500 per month plus $640 in extra income.

Income: $3,140

Expenses:

- Taxes: $460

- Home Mortgage: $400

- Credit Card Payment: $110

- Car Loan: $80

- Personal Loan: $100

- Other Expenses (groceries, utilities, etc.): $570

- Child Expenses: $140

- Total Expenses: $1,860

Current Savings: $7,370

Step 1: Count the Money

Net Cash Flow: $3,140 income – $1,860 expenses = $1,280 left each month.

Step 2: Apply Zero-Based Budgeting

Mr. Dee reviewed his spending. Actions taken:

- Pay off credit card and personal loan faster.

- Trim “other expenses” by $100 by shopping smart and canceling extras.

Step 3: Pause and Prioritize

Cancelled:

- $15 streaming subscription

- $50 monthly eating out

- $35 gym membership

Immediate Savings: another $100/month.

Step 4: See the Difference

Before: $1,280 available | After: $1,480 available

Debt goes down faster. Savings grow stronger.

Result: $2,400 extra saved over one year!

Quick Recap

- Count your money every month.

- Use zero-based budgeting to question every expense.

- Pause and prioritize spending to boost savings.

Conclusion: Your Financial Freedom Starts Now

Costs, including the impact of tariffs on your savings, will keep rising. But your choices can beat them.

Take control today:

- Track every dollar

- Challenge every expense

- Prioritize saving and debt payoff

Financial freedom isn’t luck. It’s a system. It’s habits, built one decision at a time.

Just like Mr. Dee, you can fight back and win. Start today — and build the future you deserve.