Do you know you can double … even triple your retirement savings?

Yes. It’s still possible to increase your retirement savings.That is even if you have not saved enough in your 401(K), Roth IRA or ISA presently.

You can still save as much money as you can for your retirement.

That is… if you’ll do three things:

- Save one dime of every dollar you earn,

- Invest your savings every six months.

- And seek help of an investment adviser about secure investment

This advice is simple enough that anyone can do it. But only a tiny number of working adults do retirement planning.

USA today, published an article that mentioned a national study on retirement:

the study found that 36% of workers had less than $1000 in savings and investments for retirement. And 60% of worker had less than $25000

Why majority of working adults fail to save for retirement?

One of the reasons many workers don’t have–enough saved for retirement is that–they spend more than they earn.

As a result of accumulating many everyday expenses they are unable to save enough in their 401(k) plans

The other reason many working adults don’t have-enough money save for retirement is-the way retirement savings plans are sold.

Why? Because when the financial institutions on Wall Street sell pensions and annuities. They sell investment products that invest in the stock market

The benefit of these types of investment products is: your pension pots will increase-when the stock market is booming

On the flip side when stock market values goes south, a substantial value of your pension pot is wiped out

That was what happened during the stock market crash of 2001 and depression of 2008.

The stock market crash wiped out a significant part of many baby boomers retirement savings.

The result is that majority of baby boomers have postponed retiring indefinitely.

It’s not uncommon to see many retirees over 70 still working today.

I believe that relying on Mutual funds and stocks alone for your retirement is courting disaster.

You need to do more than investing in mutual funds to have a substantial savings pot for retirement

Why? I believe that majority of us will live longer due to higher living standards

The other reason you need to take control of your retirement is the due to changes in the pension contributions law.

Pension contributions have changed from guaranteed benefit to defined benefit contributions.

Which means the responsibility of providing for your retirement-has shifted to individual workers.

The good news is you can still turn things around with your retirement savings before it‘s too late

You need to have safety with retirement savings

You see, your retirement savings is for safety. Therefore you must only invest your money in safe low risk investments

Forget about looking for double-digit returns in the stock market.

What you need to do investing for retirement is focus on preserving your capital.

Why? Because when you retire you need to start drawing down on your pension.

You need to have your money available on a monthly basis.

You need your money to be available as soon as possible.

Your money must be liquid that it can be readily converted to cash

This is why I believe when you start saving your money early enough… You may retire with substantial retirement savings.

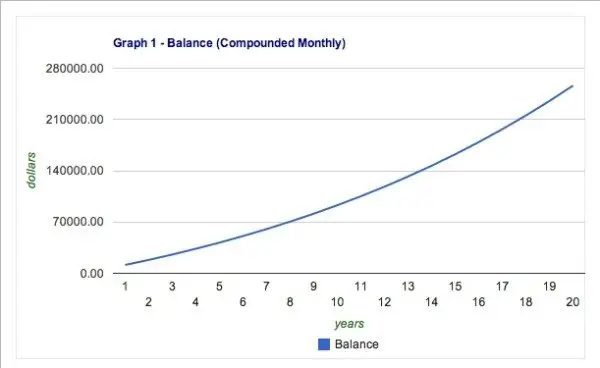

Let‘s look at the impact of saving a portion of every dollar you earned, and investing regularly with expert financial advice.

The power of saving 10 cents of every dollar you earn

Imagine you decide to start your retirement savings with a lump sum of $1000.

You then decide that you’ll be saving 10 cents of every $1 dollar you earn.

Assuming you earn $50000 per yearly and you intend to retire in 25 years time.

With an interest rate of 5% per year, here’s how your financial summary will look like

Initial deposit: $5000

Regular monthly savings: $500

Interest rate: 5 %

Number of years: 20 years

Total savings: $256,246.56

You can see that by making regular monthly of $500 deposit your retirement savings will allow you to accumulate enough to retire.

By making these small monthly deposits, you’ll retire better off than 80 percent of working adults who have not saved enough for their retirement.